-

- 거래 플랫폼

- PU Prime 앱

- PU 카피트레이딩

- PU 소셜

-

- 거래 조건

- 계좌유형

- 스프레드, 비용 & 스왑

- 입금 & 출금

- 수수료 & 요율

- 거래 시간

-

- 회사소개

- 회사개요

- PU Prime 리뷰

- 공지사항

- 뉴스룸

- PU Prime에 연락하기

- 고객센터

*U.S. equities bounced sharply, with the Nasdaq surging 2.2% after last Friday’s heavy sell-off triggered by the U.S.–China trade tensions.

*Markets recovered as Trump’s softer weekend tone eased fears of a full-blown trade escalation, though volatility remains elevated.

*Persistent enthusiasm around artificial intelligence continues to provide underlying support for Wall Street’s broader resilience.

Market Summary:

U.S. equity markets staged a sharp recovery in the last session, with the Nasdaq Composite leading the advance by surging 2.2%, or 490 points. This rebound followed one of the worst single-day sell-offs in years last Friday, which saw the Nasdaq plummet 3.6% and the S&P 500 drop 2.7%.

The initial downturn was triggered by a significant escalation in trade tensions, following an unexpected announcement from former President Donald Trump threatening 100% tariffs on China. The deterioration was exacerbated by reports that China would retaliate by tightening export controls on rare earth minerals, which are critical for technology and electronics manufacturing. This move pressured major tech stocks, with giants like Nvidia, Apple, Tesla, and AMD falling between 3.5% and 5% on Friday.

The subsequent relief rally was fueled by a perceived softer tone from Trump on trade over the weekend, which eased immediate fears of a further escalation. Underpinning the market’s broader resilience is persistent bullish sentiment surrounding artificial intelligence, which has provided a foundation of support and helped buoy the sector.

The near-term outlook for Wall Street remains highly volatile and directly contingent on the trajectory of U.S.-China trade relations. Any resumption of trade talks would likely provide a positive catalyst for the market, while a further deterioration in the relationship is expected to prolong weakness and potentially trigger another leg down.

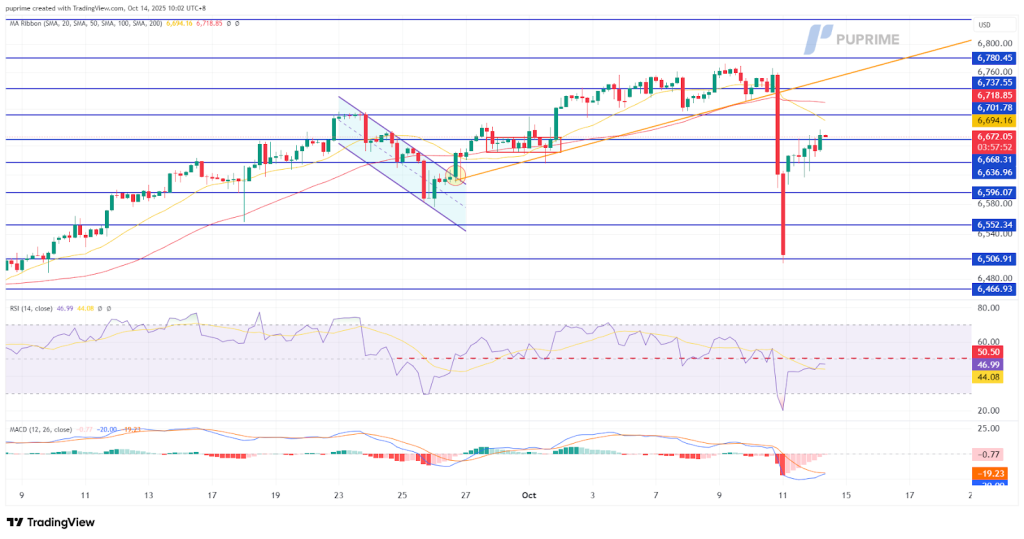

Technical Analysis

The S&P 500 is exhibiting signs of a potential trend reversal following a sharp prior decline that initially broke its previous bullish structure. The key technical development is the index’s robust recovery, which has now erased more than half of its earlier losses. Crucially, it has breached the significant Fibonacci retracement level of 61.8% at the 6660.00 mark. This breach suggests underlying buying strength and often precedes a resumption of the prior trend.

For a confirmed bullish reversal to be justified, the index must demonstrate an ability to consistently find support and sustain trading above the 6660.00 level in the upcoming sessions. A successful hold above this threshold would provide a stronger technical foundation for further upward movement.

However, this optimistic price action is challenged by lagging momentum indicators. The Relative Strength Index (RSI) remains below its mid-point, and the Moving Average Convergence Divergence (MACD) continues to trade below its zero line. Both oscillators indicate that bearish underlying momentum persists, creating a divergence with the price recovery. The near-term trajectory will be determined by whether price action can overcome this momentum deficit. A conclusive break above the next resistance level is needed to solidify the reversal and force a reset in momentum readings.

Resistance Levels: 6700.00, 6740.00

Support Levels: 6636.30, 6597.00

업계 최저 스프레드와 초고속 실행으로 FX, 지수, 귀금속 등을 거래하실 수 있습니다!

Please note the Website is intended for individuals residing in jurisdictions where accessing the Website is permitted by law.

Please note that PU Prime and its affiliated entities are neither established nor operating in your home jurisdiction.

By clicking the "Acknowledge" button, you confirm that you are entering this website solely based on your initiative and not as a result of any specific marketing outreach. You wish to obtain information from this website which is provided on reverse solicitation in accordance with the laws of your home jurisdiction.

Thank You for Your Acknowledgement!

Ten en cuenta que el sitio web está destinado a personas que residen en jurisdicciones donde el acceso al sitio web está permitido por la ley.

Ten en cuenta que PU Prime y sus entidades afiliadas no están establecidas ni operan en tu jurisdicción de origen.

Al hacer clic en el botón "Aceptar", confirmas que estás ingresando a este sitio web por tu propia iniciativa y no como resultado de ningún esfuerzo de marketing específico. Deseas obtener información de este sitio web que se proporciona mediante solicitud inversa de acuerdo con las leyes de tu jurisdicción de origen.

Thank You for Your Acknowledgement!