-

- 거래 플랫폼

- PU Prime 앱

- PU 카피트레이딩

- PU 소셜

-

- 거래 조건

- 계좌유형

- 스프레드, 비용 & 스왑

- 입금 & 출금

- 수수료 & 요율

- 거래 시간

-

- 회사소개

- 회사개요

- PU Prime 리뷰

- 공지사항

- 뉴스룸

- PU Prime에 연락하기

- 고객센터

*Oil prices extended losses after Israel and Hamas reached a ceasefire, easing geopolitical tensions and erasing the Middle East risk premium.

*OPEC+ output hit a 29-month high, led by increased exports from Saudi Arabia and Russia as production cuts are unwound.

*Iranian and Venezuelan exports are rising, amplifying the perception of a well-supplied market.

Market Summary:

Crude oil prices extended their decline this week as geopolitical tensions in the Middle East eased following the announcement of a landmark ceasefire between Israel and Hamas. The agreement, seen as a pivotal step toward regional stability, has erased much of the risk premium that had kept prices elevated in recent months. Market sentiment has turned cautious, with traders reassessing supply-demand dynamics now that a broader regional escalation appears less likely. The reduction in geopolitical tension coincides with rising evidence of ample global supply, further pressuring crude benchmarks.

On the supply side, OPEC+ output has risen to a 29-month high, driven by increased exports from Saudi Arabia and Russia as earlier production cuts are gradually unwound. U.S. crude production has also rebounded to a record 13.6 million barrels per day, and the EIA has lifted its 2025 output forecast, signaling that the supply overhang could persist. Meanwhile, global seaborne shipments from sanctioned producers—including Iran and Venezuela—continue to climb, reinforcing perceptions of a well-supplied market. These developments have weighed on technical sentiment, with WTI failing to sustain a breakout above its key moving averages and now approaching major support near $58 per barrel.

Still, structural undercurrents could prevent a deeper collapse. Stalled Ukraine peace efforts keep Russian supply constraints in place, while resilient U.S. demand offers some offset to global weakness. However, with the ceasefire deflating the geopolitical risk premium and the macroeconomic outlook softening amid the U.S. shutdown, the balance of risks leans to the downside in the near term. Traders will watch whether crude can stabilize above key technical levels or if the recent breakdown marks the start of a deeper corrective phase.

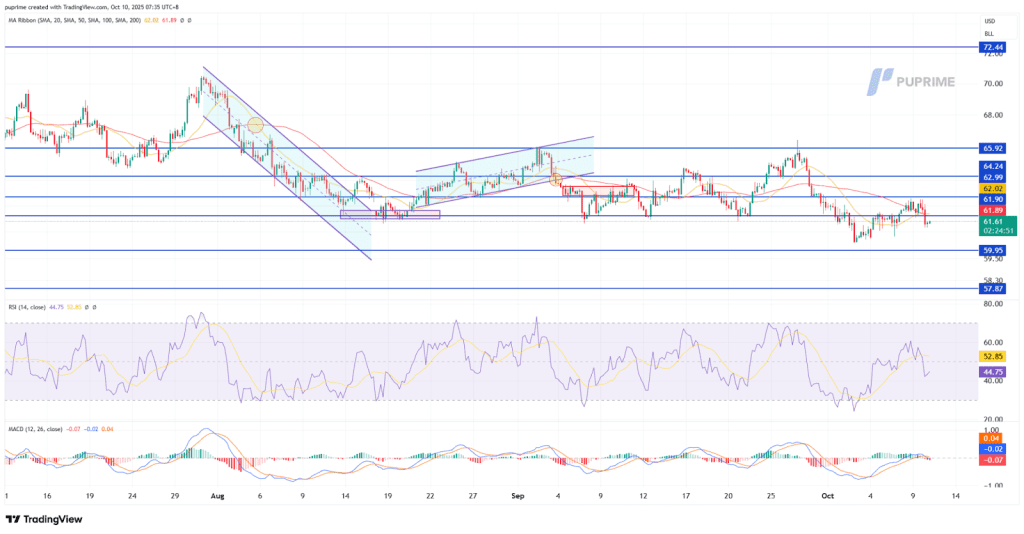

USOIL, H4:

WTI crude prices continued to trade under pressure, hovering near $61.60 after repeated rejections from the $64.30 resistance zone. The short-term structure remains bearish, with the price capped below the 20- and 50-period moving averages, both sloping downward and acting as dynamic resistance. The recent breakdown from the minor ascending channel reinforces selling bias, suggesting bears are regaining control after last week’s failed attempt to sustain above $63.00.

Momentum indicators confirm the weakening tone that the RSI slipped to 44, indicating fading buying momentum, while the MACD has turned flat to slightly negative, hinting at continued sideways-to-down pressure. Immediate support lies at $59.95, followed by $57.90, levels that previously triggered technical rebounds. A recovery above $63.00 would be needed to reestablish bullish traction toward $64.25.

Overall, crude remains vulnerable to further downside correction as easing geopolitical risks and persistent demand concerns overshadow supply cuts, keeping short-term bias negative unless a clear rebound above the 50-SMA materializes.

Resistance level: 61.90, 63.00

Support level: 59.95, 57.90

업계 최저 스프레드와 초고속 실행으로 FX, 지수, 귀금속 등을 거래하실 수 있습니다!

Please note the Website is intended for individuals residing in jurisdictions where accessing the Website is permitted by law.

Please note that PU Prime and its affiliated entities are neither established nor operating in your home jurisdiction.

By clicking the "Acknowledge" button, you confirm that you are entering this website solely based on your initiative and not as a result of any specific marketing outreach. You wish to obtain information from this website which is provided on reverse solicitation in accordance with the laws of your home jurisdiction.

Thank You for Your Acknowledgement!

Ten en cuenta que el sitio web está destinado a personas que residen en jurisdicciones donde el acceso al sitio web está permitido por la ley.

Ten en cuenta que PU Prime y sus entidades afiliadas no están establecidas ni operan en tu jurisdicción de origen.

Al hacer clic en el botón "Aceptar", confirmas que estás ingresando a este sitio web por tu propia iniciativa y no como resultado de ningún esfuerzo de marketing específico. Deseas obtener información de este sitio web que se proporciona mediante solicitud inversa de acuerdo con las leyes de tu jurisdicción de origen.

Thank You for Your Acknowledgement!