-

- 거래 플랫폼

- PU Prime 앱

- PU 카피트레이딩

- PU 소셜

-

- 거래 조건

- 계좌유형

- 스프레드, 비용 & 스왑

- 입금 & 출금

- 수수료 & 요율

- 거래 시간

-

- 회사소개

- 회사개요

- PU Prime 리뷰

- 공지사항

- 뉴스룸

- PU Prime에 연락하기

- 고객센터

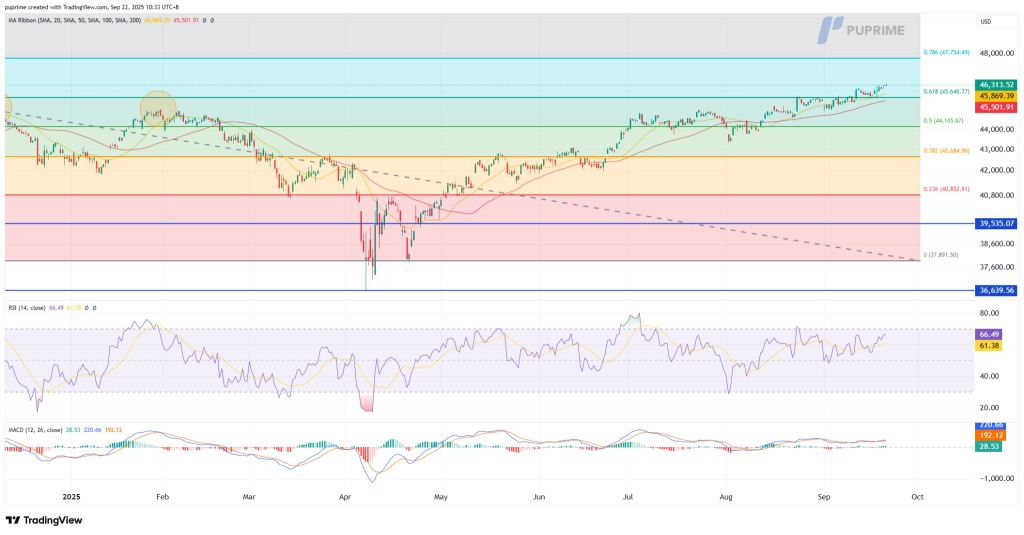

Dow Jones, H4:

The Dow Jones Index has extended its upward trajectory, reclaiming ground above the 45,650 Fibonacci zone and pushing toward the next key resistance at 47,750. This advance underscores the resilience of the broader uptrend, with the index steadily building on gains since the mid-year recovery. The ability to hold above the 45,500–45,700 region now serves as a pivotal confirmation of continued bullish momentum.

Price structure reflects a constructive outlook, with buyers maintaining control and higher lows reinforcing a supportive base for further upside. A decisive break above 47,750 would open the way toward fresh highs, while failure to breach this level could trigger short-term consolidation back toward 45,650 or 44,165.

Momentum indicators are leaning bullish: the RSI has climbed to 66, approaching overbought conditions but still showing healthy upside strength, while the MACD remains in positive territory, with its histogram expanding and signal lines trending upward, confirming sustained buying pressure.

Overall, the Dow maintains a strong bullish bias above 45,500, with scope for an extension toward 47,750 and potentially beyond if momentum persists.

Resistance Levels: 47,750.00, 50,400.00

Support Levels: 45,650.00, 44,165.00

NZDUSD, H4

The NZD/USD pair has broken decisively below the $0.5890 support level, which had held as a critical floor through much of September, signaling a potential extension of its broader bearish trend. The pair has already shed more than 3% this month, with the latest breakdown reflecting renewed selling pressure and fading demand for the kiwi.

The breach of this support underscores strengthening downside conviction, leaving the pair vulnerable to further declines toward the next technical zone near $0.5795. Sustained weakness below $0.5890 could reinforce bearish control, shifting focus toward the $0.5795 level if momentum persists.

Momentum conditions align with the bearish bias: the RSI is hovering near 25, deep in oversold territory, highlighting strong downside pressure, while the MACD has extended further into negative territory, confirming accelerating bearish momentum.

In the near term, resistance now lies at the former support zone around $0.5890, with only a decisive recovery above this threshold likely to ease immediate bearish pressure. Until then, the path of least resistance remains lower.

Resistance Levels: 0.5890, 0.5925

Support Levels: 0.5850, 0.5795

업계 최저 스프레드와 초고속 실행으로 FX, 지수, 귀금속 등을 거래하실 수 있습니다!

Please note the Website is intended for individuals residing in jurisdictions where accessing the Website is permitted by law.

Please note that PU Prime and its affiliated entities are neither established nor operating in your home jurisdiction.

By clicking the "Acknowledge" button, you confirm that you are entering this website solely based on your initiative and not as a result of any specific marketing outreach. You wish to obtain information from this website which is provided on reverse solicitation in accordance with the laws of your home jurisdiction.

Thank You for Your Acknowledgement!

Ten en cuenta que el sitio web está destinado a personas que residen en jurisdicciones donde el acceso al sitio web está permitido por la ley.

Ten en cuenta que PU Prime y sus entidades afiliadas no están establecidas ni operan en tu jurisdicción de origen.

Al hacer clic en el botón "Aceptar", confirmas que estás ingresando a este sitio web por tu propia iniciativa y no como resultado de ningún esfuerzo de marketing específico. Deseas obtener información de este sitio web que se proporciona mediante solicitud inversa de acuerdo con las leyes de tu jurisdicción de origen.

Thank You for Your Acknowledgement!