-

- 거래 플랫폼

- PU Prime 앱

- PU 카피트레이딩

- PU 소셜

-

- 거래 조건

- 계좌유형

- 스프레드, 비용 & 스왑

- 입금 & 출금

- 수수료 & 요율

- 거래 시간

-

- 회사소개

- 회사개요

- PU Prime 리뷰

- 공지사항

- 뉴스룸

- PU Prime에 연락하기

- 고객센터

*The Pound has remained steady amid a calm domestic backdrop and the Bank of England’s decision to hold rates unchanged, reinforcing policy predictability.

*Upcoming UK economic releases, particularly unemployment and GDP figures, are expected to dictate short-term volatility in Sterling.

*Thursday’s GDP report stands out as the pivotal data point, with an upside surprise likely to strengthen the Pound further.

Market Summary:

The Japanese yen recovered late last week after suffering a sharp drop earlier, as renewed market The The British Pound has exhibited a phase of relative stability in recent sessions. This period of calm can be attributed to a lack of disruptive domestic economic data or significant political turmoil of the kind witnessed in other major economies such as the United States, Japan, and France. The currency’s steadiness was further reinforced by the Bank of England’s (BoE) latest monetary policy decision, where a majority of the Monetary Policy Committee voted to hold interest rates unchanged. This outcome has fostered a market perception of a more predictable and stable policy trajectory in the near term. Furthermore, recent economic releases have generally met expectations, thereby contributing to a supportive environment for the Pound.

However, this period of stability is likely to be tested in the immediate future. The market anticipates heightened volatility for Sterling this week, driven by the release of several key economic indicators.

The UK Unemployment Rate, scheduled for release tomorrow, is forecast to remain unchanged at 4.7%. Should the data confirm this consensus, its impact on the currency is expected to be limited. The more significant market mover is likely to be the Gross Domestic Product (GDP) figure due on Thursday. Current expectations point towards an improvement in the growth data, and a positive print has the potential to bolster the Pound’s value.

In summary, while the Pound has benefited from a stable policy backdrop and a lack of negative surprises, its near-term direction will be determined by incoming high-frequency data, with Thursday’s GDP report representing the primary risk event for the currency this week.

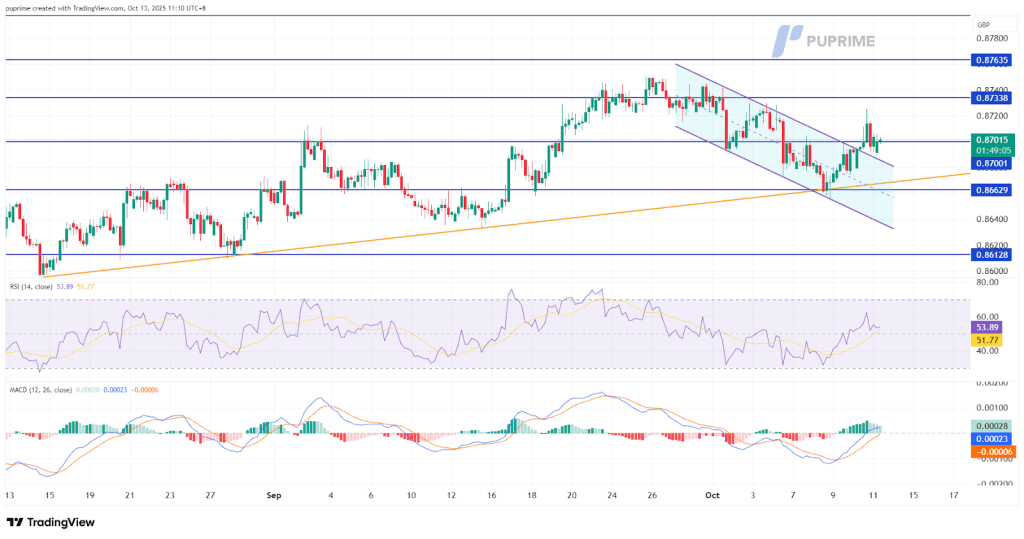

Technical Analysis

The EURGBP cross has exhibited a significant shift in its technical structure, signaling a potential reversal of its prior downtrend. The pair successfully maintained its position above a critical long-term upward trendline, finding reliable support at the 0.8660 level. This defense of key support was followed by a decisive break above the pair’s previous downtrend channel, an event that technically constitutes a breakdown of the established bearish structure. This combination of factors suggests a transition in market sentiment and points to a credible bullish trend reversal.

This constructive price action is being corroborated by momentum indicators. The Relative Strength Index (RSI) has notably rebounded from its oversold territory, reflecting a return of buying pressure. Concurrently, the Moving Average Convergence Divergence (MACD) indicator has executed a bullish crossover, known as a “golden cross,” at depressed levels and has now advanced above its zero line. This specific sequence—a crossover from deeply oversold conditions followed by a zero-line break—is a strong technical signal that fresh positive momentum is building.

Resistance levels: 0.8735, 0.8765

Support levels: 0.8663, 0.8613

업계 최저 스프레드와 초고속 실행으로 FX, 지수, 귀금속 등을 거래하실 수 있습니다!

Please note the Website is intended for individuals residing in jurisdictions where accessing the Website is permitted by law.

Please note that PU Prime and its affiliated entities are neither established nor operating in your home jurisdiction.

By clicking the "Acknowledge" button, you confirm that you are entering this website solely based on your initiative and not as a result of any specific marketing outreach. You wish to obtain information from this website which is provided on reverse solicitation in accordance with the laws of your home jurisdiction.

Thank You for Your Acknowledgement!

Ten en cuenta que el sitio web está destinado a personas que residen en jurisdicciones donde el acceso al sitio web está permitido por la ley.

Ten en cuenta que PU Prime y sus entidades afiliadas no están establecidas ni operan en tu jurisdicción de origen.

Al hacer clic en el botón "Aceptar", confirmas que estás ingresando a este sitio web por tu propia iniciativa y no como resultado de ningún esfuerzo de marketing específico. Deseas obtener información de este sitio web que se proporciona mediante solicitud inversa de acuerdo con las leyes de tu jurisdicción de origen.

Thank You for Your Acknowledgement!